Understand the Financial Product Usage and Behaviors of the Under-Banked

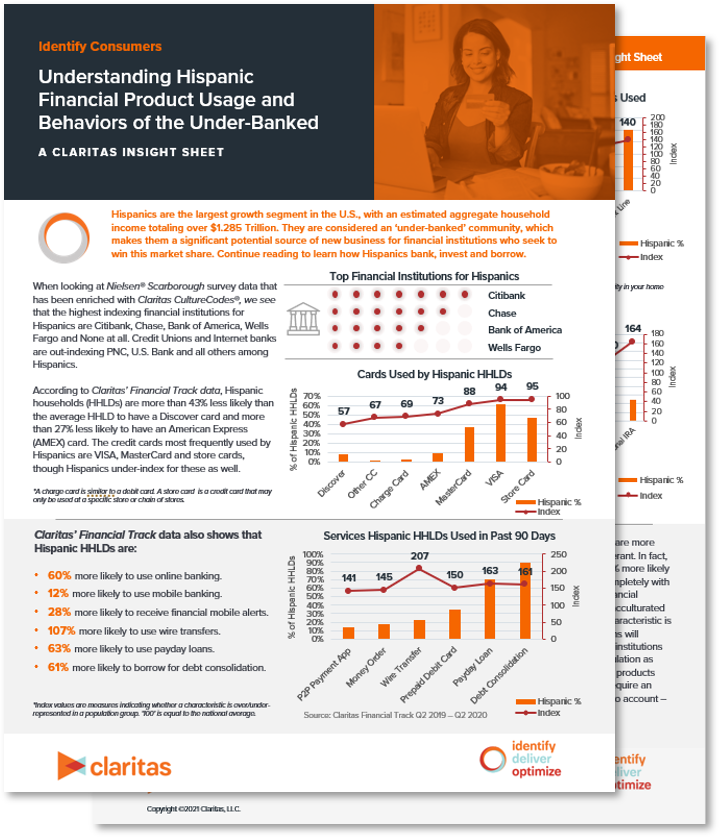

In this insights sheet, Claritas examines the financial product usage and behaviors of Hispanic households in the U.S., through the lens of Claritas’ Financial Track data and Nielsen® Scarborough survey data that has been enriched with Claritas CultureCodes®. Hispanics are the largest growth segment in the U.S., with an estimated aggregate household income totaling over $1.285 Trillion. They are considered an ‘under-banked’ community, which makes them a significant potential source of new business for financial institutions who seek to win this market share. Continue reading to learn how Hispanics bank, invest and borrow.

Claritas' Financial Track data shows that Hispanic Households are:

- 107% more likely to use wire transfers.

- 63% more likely to use payday loans.

- 30% more likely to have a direct auto loan.

- 40% more likely to have a revolving credit line.

Know more about how Claritas can help you succeed in today's market, contact us at 800.234.5973 or visit www.claritas.com.